Excise Tax Manager for BigCommerce

Price: $294.99 / Month - Free Trial

The Excise Tax Manager App for BigCommerce is a flexible application that enables merchants to charge excise tax for products or groups of products based on the order shipping address.

This solution is a part of the Ebizio Checkout app. To get it, navigate to the BigCommerce App Marketplace to install the Ebizio Checkout App and then subscribe to this module.

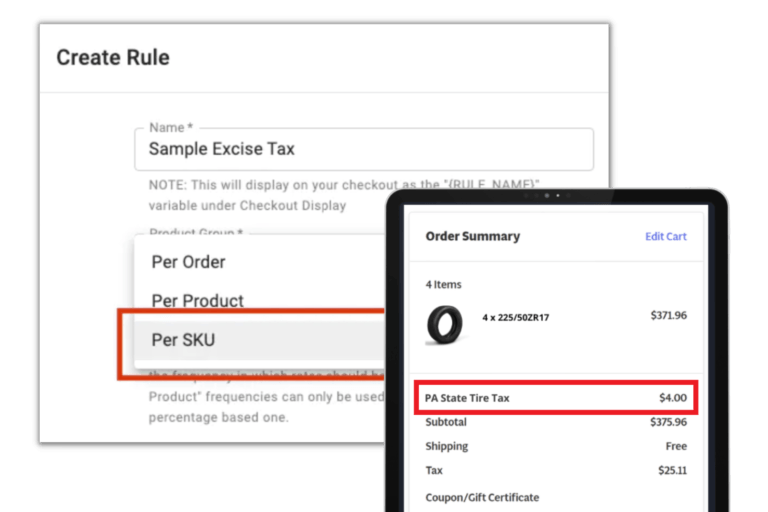

Apply Excise Tax to Different Products and Geographic Zones

With the Excise Tax Manager, businesses in heavily regulated and taxed industries, such as vape products, alcohol, and firearms, can collect accurate, line-itemed taxes for specific products and groups of products.

The Excise Tax App for BigCommerce provides merchants with an easy way to configure the appropriate excise taxes for their storefront products. Taxes can be applied to individual products or groups of products and calculated with pinpoint accuracy for defined geographic zones.

Don’t risk getting hit with hefty penalties and paying more down the road. Save time, effort, and money by implementing the Excise Tax Manager app on your BigCommerce site.

Features & Benefits

Mixed Cart Support

Carts may contain both products that have an additional excise taxes applied and products that do not, providing a frictionless checkout experience regardless of the items in a customer's cart.

Seamless Customer Experience

Excise taxes are clearly displayed as a separate line item in the cart and checkout, as well as on the order confirmation email. A seamless shopping experience with no surprises.

Compatible & Secure

Compatible with all BigCommerce themes, in combination with the Optimized One-Page Checkout. Meets PCI Compliance standards with the BigCommerce checkout.

App Features

The Ebizio Checkout App includes several modules, each offering unique solutions to extend the functionality of the BigCommerce open-source checkout.

Ship On Account

The Ship on Account Module will allow your customers to have their orders shipped on an existing account with a shipping provider.

Subscription Price: $79.99/mo

Purchase Order

The Purchase Order Module will allow your customers to seamlessly place a Purchase Order directly through your Bigcommerce website.

Subscription Price: $79.99/mo

Customer Group Shipping Rules

Allow pre-approved customers to access hidden Shipping Methods on your BigCommerce checkout.

Subscription Price: $79.99/mo

Customer Group Payment Rules

Allow pre-approved customers to access hidden Payment Methods on your BigCommerce store.

Subscription Price: $79.99/mo

Shipping Protection

Offer delivery protection for products in your store that covers packages from being lost, stolen, or damaged in transit.

Subscription Price: $294.99/mo

Product Fees Manager

Add optional product fees, handling expenses, or surcharges, such as discreet packaging, express delivery, etc.

Subscription Price: $194.95/mo

Colorado Retail Delivery Fees

Seamlessly charge the required $0.27 retail delivery fee on taxable goods for Colorado shoppers.

Subscription Price: $49.95/mo

Destination Based Product Fees

Seamlessly apply custom fees on products or groups of products based on the shipping destination.

Subscription Price: $294.99/mo

Excise Tax Manager

A flexible application that enables merchants to charge excise tax for products or groups of products based on the order shipping address.

Subscription Price: $294.99/mo

Style Editor

Update the basic styles of your BigCommerce checkout to improve conversion and conform to your branding.

Subscription Price: $29.99/mo

Text Editor

Customize any auto-generated text that appears in your BigCommerce checkout. Great for including instructions or unique branding.

Subscription Price: $29.99/mo

Need Something Custom?

If you're seeking a checkout solution we don't have yet, contact us to discuss your needs and our custom checkout solution services.

Schedule a Demo

Fill out our contact form and one of our BigCommerce experts will get back to you within 24 hours to schedule a demo of the app.