Introduction

We get A LOT of requests for customizations and integrations on the BigCommerce platform, ranging from simple User Experience updates to complicated, multi-system connectors. When we identify recurring requests from our customer base and the BigCommerce community, we sit down together to evaluate those requests and determine if the need is really there for our customers.

One request continually popped up for our customers, and businesses looking to use BigCommerce for their ecommerce website:

Calculating and charging for excise taxes, directly in the BigCommerce Checkout.

With new innovations available from BigCommerce, including their Open Source Checkout and revamped Checkout API, we decided that now was the time to provide that solution to all BigCommerce users.

What is Excise Tax?

First, let’s clearly define the term ‘excise tax.’

Excise taxes are additional taxes, or fees, levied on more heavily regulated products, such as tobacco, alcohol, and fuel. These taxes can vary widely based on where a given product is being purchased, sometimes all they way down to the individual Zip Code level, but more often at the municipality, county, or state level. Additionally, some counties or states will charge a flat rate per product sold, while others charge a percentage of product sales.

Excise Tax law is notoriously complex, making it difficult for store owners, brick and mortar OR ecommerce, to fully and confidently comply with their local and national laws.

Excise Taxes on Ecommerce Solutions

Businesses that sell these regulated goods are responsible for excise taxes in the same way that they are responsible for sales tax. They must collect the taxes and remit them accurately.

For an ecommerce site, this means that store owners need to be able to collect these taxes based on location, tax type (flat rate or percentage), and product being sold. With no native solution to calculate or separate these taxes on SaaS platforms like BigCommerce, store owners face a significant burden to attempt to accommodate the tax laws.

Work around solutions pose significant problems as well, often requiring hundreds of hours of additional accounting work to separate sales and excise taxes, maintaining multiple product databases, collecting taxes separately from ecommerce orders, inflating product prices to include taxes (making competitive pricing difficult), and more.

Why is Now the Time to Solve for Excise Tax?

These taxes have always been an issue for merchants, but with the recent explosion in popularity of regulated products on ecommerce sites, more websites than ever have been negatively affected by the lack of solutions available.

So how do we solve for this complex problem, and make the solution available to all BigCommerce store?

The Excise Tax Manager App

We have developed a seamless app that will allow store owners to assign excise tax rates to different groups of products and geographic zones.

The Excise Tax App for BigCommerce is a flexible application that will enable merchants to charge excise tax based on the order shipping address. Businesses in heavily regulated and taxed industries, such as vape products, alcohol, and firearms, can collect accurate, line-itemed taxes for specific products and groups of products.

Save time, effort, and money by implementing this excise tax / add-on fee app on your BigCommerce site.

How Does it Work?

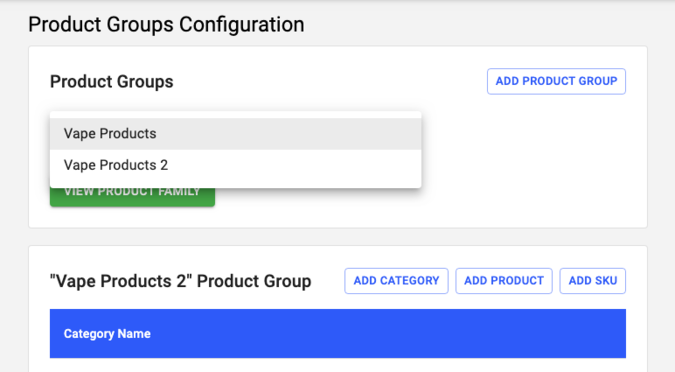

Step One: Create a ‘Product Group’

BigCommerce merchants can create a ‘Product Group’ by choosing Product Categories or individual Products from the BigCommerce product database. Merchants will group their Products based on the excise taxes that will need to be applied.

For example, vape products may be taxed differently based on the level of nicotine contained in the product. Merchants will create individual Product Groups for each level of nicotine, and assign SKUs from their existing product database to those Groups based on the corresponding levels.

Now that the taxable products have been organized into logical groups, we’ll proceed to the next step:

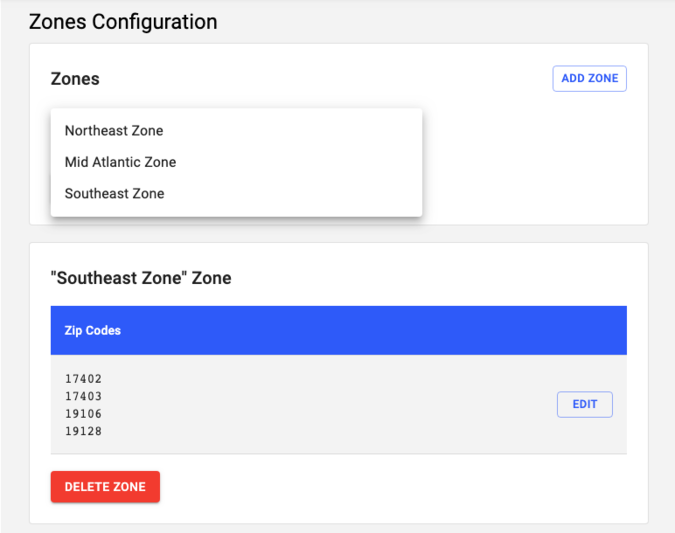

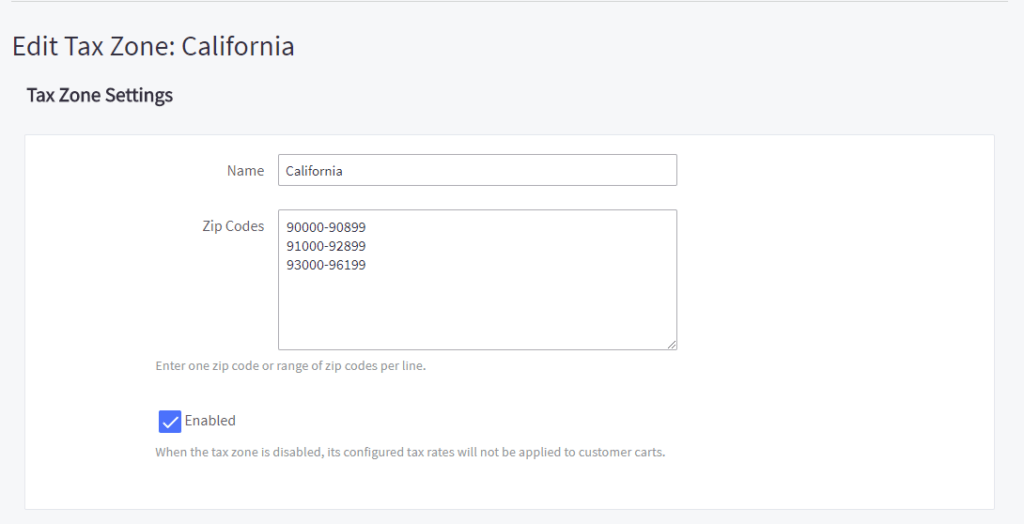

Step Two: Create a Geographic Zone

The major complexity of excise taxes comes from the multitude of laws that can be applied at nearly every level of government from municipalities to counties to states to federal. In order to comply with laws from all of these regions, we’ll need to create geographic zones that correspond to the excise tax zones.

The merchant can create geographic zones based on individual zip codes, and zip code ranges, for each destination that requires a unique excise tax or additional fee. Create multiple zones to accommodate for different product requirements. (Currently accommodates for USA zip codes only)

So now that we have created Product Groups and Geographic Zones, we’ll need to marry the two and apply the appropriate rate(s):

Step Three: Apply Excise Tax Rates

In the final step, merchants will pair Product Groups and Geographic Zones, and apply a tax rate with a number of important variables.

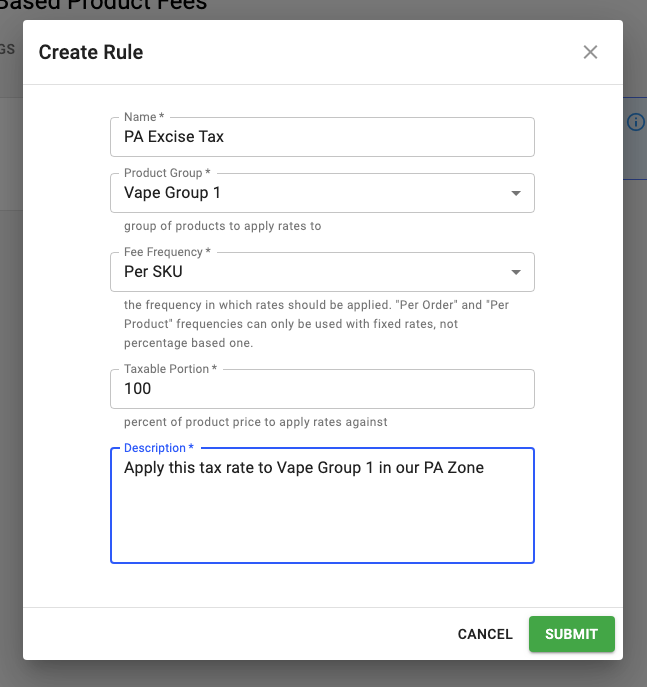

First a new Rule will be created. Rules can be named according to their application, specific excise tax, etc. This rules name will be what is displayed to your customers at checkout when excise tax is applied to an order.

Then select your Product Group from a dropdown list, and choose the ‘Fee Frequency,’ which can be per SKU, per Product, or per Order, depending on how exactly the excise tax is calculated. Then enter the taxable portion. Sometimes only a portion of a product is taxable, but in most cases this will be 100%. Finally, add a brief description, and submit your new rule.

Once a new Rule has been created, a Rate can now be created and applied. Add a Rate to your Rule by choosing the Rate Type and Rate Value (percentage or flat rate), and then choosing the Zone to which this Rate should be applied. Hit submit and you are ready to go!

Complete this process for all of combinations of taxable products and their destinations, and excise tax will be added to the Order.

Additional Features and Specifications of Excise Tax Manager

Setting up the excise tax rules is intuitive and flexible enough to account for nearly any excise tax scenario. But there are a lot of other app features that make this a superior solution.

Customer Experience

By default, excise taxes will be displayed as a separate line item per product in the cart and checkout, as well as on the order confirmation email. There is also a setting that will allow merchants to display ALL excise taxes in an order on a single line. Keeping these excise taxes separate from Sales Tax will keep your customer informed, and eliminate a lot of customer service questions.

Merchant Experience

The entirety of the Excise Tax Manager will be accessible as an app directly from your BigCommerce dashboard. Easily configure and update all settings directly from your BigCommerce store admin panel.

Taxes will be displayed as a separate line item per product on the order record in BigCommerce by default, or can be toggled to display as a single line item for total excise tax. They will also be logged as a separate line item on Orders exports from BC. This will be HUGELY appreciated by accounting and compliance departments, saving an incredible amount of time spent tedious calculating and separating excise taxes.

Discounts and Coupons

When a tax is set to be calculated based on a percentage of the Product Price, all other discounts will be applied to the product price first, and then tax will be calculated based on the price of the product(s) once added to the cart. Store owners can still leverage sitewide discounts, category discounts, individual product sales / discounts, and coupons without skipping a beat.

Mixed Carts

Carts may contain both products that have an applied tax rate and products that are taxed based on the standard BigCommerce tax settings, providing a seamless checkout experience regardless of the items in a customer’s cart.

Compatibility and Support

Our goal with this application was to create a solution that was compatible with all BigCommerce sites with as few limitations as possible.

Compatibility with other BigCommerce Apps

Our solution is compatible with most other BigCommerce apps, including (most importantly) apps like Avalara and TaxJar that merchants may have configured for complex Sales Tax calculations. If your store has apps that specifically customize, or replace, the BigCommerce Checkout process, we’ll need to consult with you and your store before installing the excise tax manager.

Works with all BC Payment Methods

Additionally, our solution is compatible with all BC payment methods, with one simple caveat. In order to calculate a destination based tax, we need to know the destination! So Customers must enter the checkout process and enter their Shipping Address in order for us to calculate the appropriate taxes. We will suggest removing payment methods such as PayPal Express or Amazon pay from the Cart Page (before they get to enter an address), but those methods can still be selected in the Checkout after the Shipping Address has been entered.

In-App Support

In-App support via Zendesk will be included in the monthly fee. Additionally, extensive documentation and FAQs will be made available to all Excise Tax Manager customers.

Other Applications of Excise Tax Manager

You may also see this app referred to as “Destination Based Product Fees.” While the primary solution we provide is designed for Excise Taxes, this application can be leveraged to solve for a number of other scenarios that don’t currently have a solution on the BigCommerce platform.

Take for instance a specialized ‘Cold Shipping’ fee that a store needs to charge to ship their flash-frozen seafood across the country. This store wants to charge more if they need to ship farther, since they will need to pack the shipment with more dry ice and better insulation for a longer trip. This store can group their products into Product Groups, create Zones radiating from their shipping facility based on the number of days of transit to the destination, and charge an additional Flat Fee Rate based on the destination.

The possible applications for this app are limitless. Have an idea about how to use this on your site? Don’t hesitate to reach out for a demo and to review your specifications.

Get in Touch Today

Interested in learning more about the Excise Tax Manager app?

Please reach out to us today for a custom quote, and to review your unique specifications.

Call us at 1.866.843.4650 or Contact Us today!