A growing online merchant came to IntuitSolutions facing a unique challenge: selling a regulated product (tires) subject to excise tax, they needed a reliable way to calculate and charge tire taxes based on buyers’ shipping destination. IntuitSolutions stepped in to implement a custom solution that integrated seamlessly with their BigCommerce Storefront.

The Challenge: Reliably Calculate Excise Tax Based on Shipping Destination

Businesses that sell regulated goods – such as tires, tobacco, alcohol, and fuel – are required to collect excise tax in the same way they do sales tax. Merchants must accurately collect and remit the taxes to the federal, state, or local government where the tax is required. Excise taxes vary based on where products are shipped – most often set at the destination’s local, county, or state level but can also be specific to zip code. Some counties or states mandate a flat rate per product sold, while others charge a percentage of product sales.

For online merchants, this means charging and collecting taxes based on location, tax type (flat rate or percentage), and product sold. With no native solution to calculate or separate these taxes on ecommerce platforms, online stores face a significant burden attempting to accommodate the tax laws.

“Businesses in heavily regulated and taxed industries, such as vape products, tires, alcohol, and firearms, must collect accurate, line-itemed taxes for specific products and groups of products.”

Not having an integrated solution within their store can pose significant problems for ecommerce merchants, often requiring hundreds of hours of additional accounting work to separate sales and excise taxes. This may require maintaining multiple product databases, collecting taxes separately from online orders, or inflating product prices to include taxes — making competitive pricing difficult.

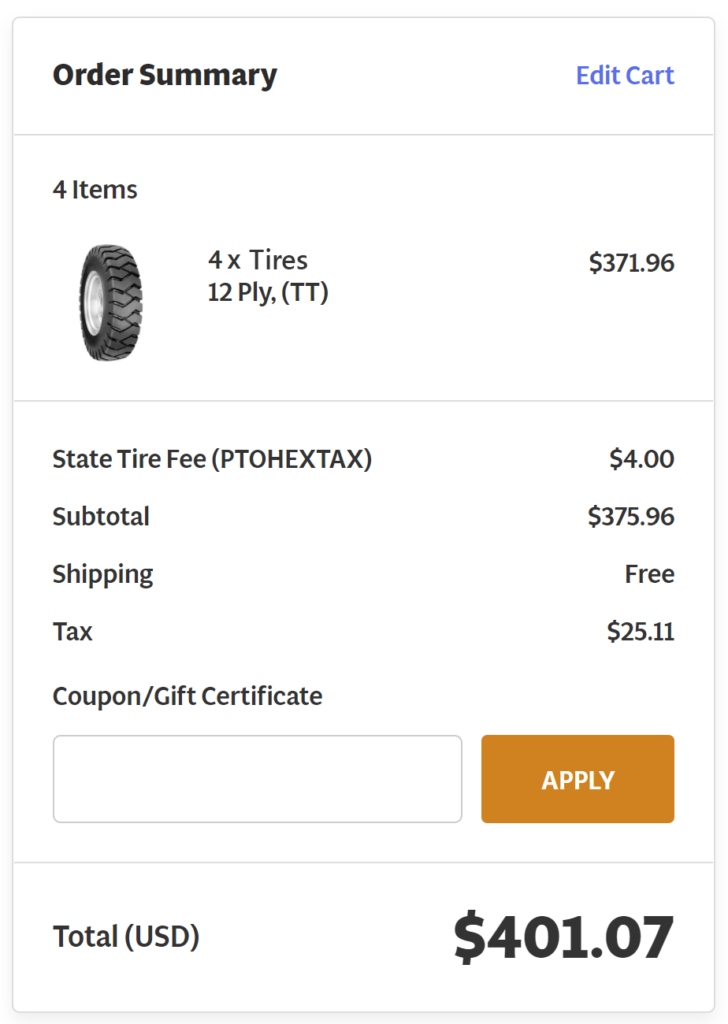

The online tire retailer needed a way to fully comply with widely diverse tax laws by accurately calculating and charging tire taxes based on the customer’s shipping address. It was also essential to provide transparency for customers by clearly labeling applicable tire tax fees in the checkout. Excise/tire tax needs to be a separate line item, and not confused with sales tax.

The Solution: A BigCommerce App to Sell Regulated Products – Excise Tax Manager

IntuitSolutions solved the challenge by implementing the Excise Tax Manager for BigCommerce, a seamless, flexible app enabling ecommerce businesses to assign excise tax rates to different groups of products and geographical areas. With Excise Tax Manager, the merchant can control the areas where tax is levied as well as the tax rate for each product, ensuring it’s calculated with pinpoint accuracy.

Designed to account for most tax scenarios, the Excise Tax Manager enables the retailer to configure groups of products and geographic zones, map corresponding up-charges by dollar amount or percent, and apply fees at the SKU, product, or order level. This provides a seamless way to accurately charge customers for tire taxes levied at any level (municipality, county, state, etc.)

The Excise Tax Manager comes ready to implement in BigCommerce with the following features:

Fee Transparency: The excise tax is added and clarified as a separate line item on the cart at checkout, helping customers understand exactly what each charge means.

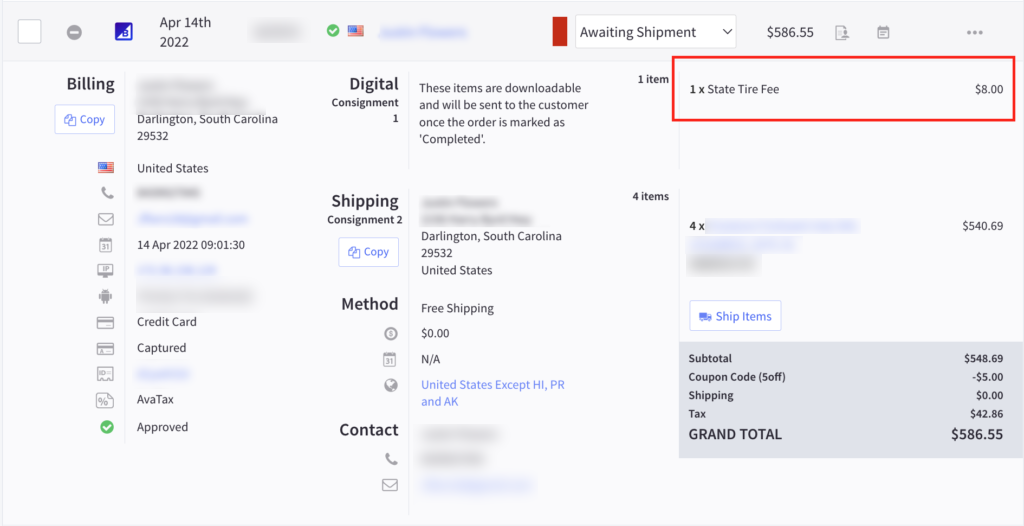

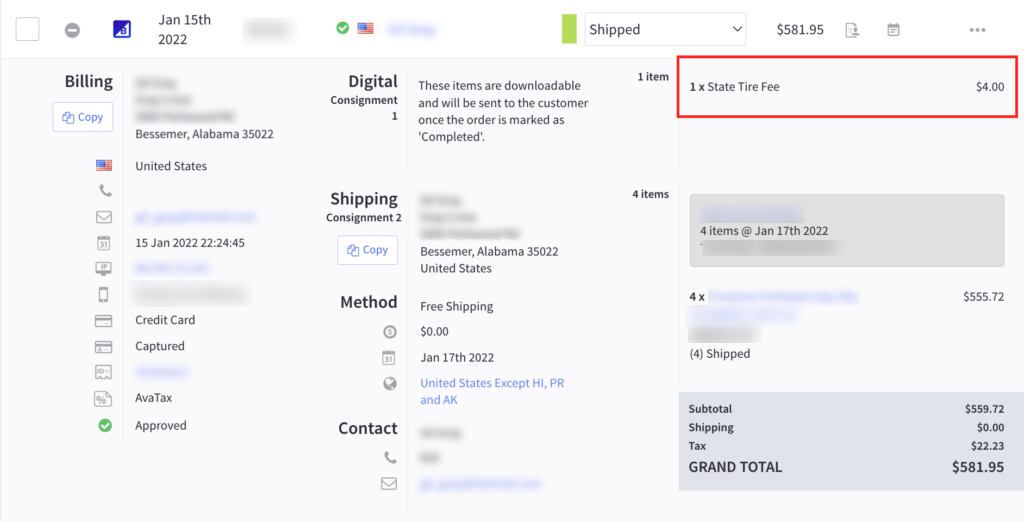

Seamless Merchant Experience: The entirety of the Excise Tax Manager is accessible as an app directly within the BigCommerce dashboard. Merchants can easily configure and update all settings directly from the BigCommerce store admin panel.

Discount and Coupon Compatibility: Store owners can still leverage sitewide discounts, category discounts, individual product sales / discounts, and coupons without checkout disruption.

Mixed Cart Support: Carts may contain a mix of products with an applied tax rate and products that are taxed based on the standard BigCommerce tax settings. This provides a seamless checkout experience regardless of the items in a customer’s cart.

BigCommerce Payment Integration – Excise Tax Manager is compatible with all BigCommerce payment methods, with one simple requirement: in order to calculate a destination based tax, we need to know the destination!

App Compatibility – Excise Tax Manager is compatible with most other BigCommerce apps, including Avalara and TaxJar, which merchants may implement for complex sales tax calculations.

In-App Support – Ongoing support via Zendesk is included in the monthly fee. Additionally, extensive documentation and FAQs is made available to all Excise Tax Manager customers.

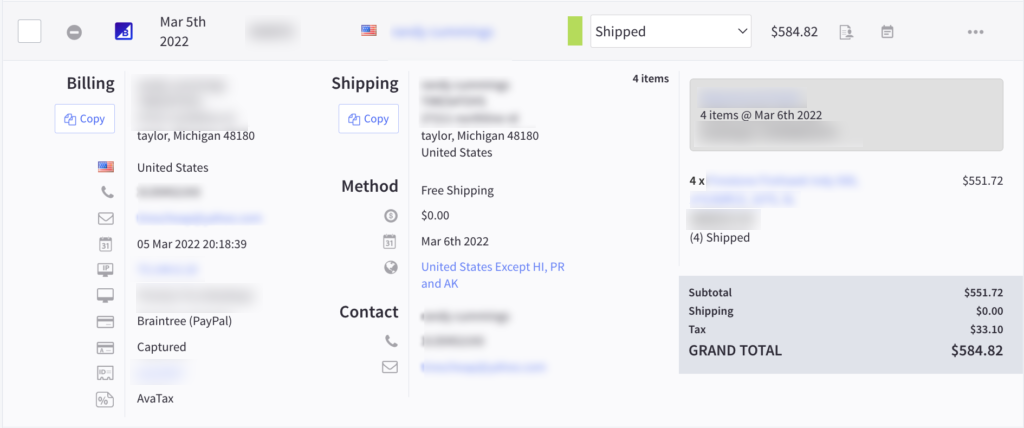

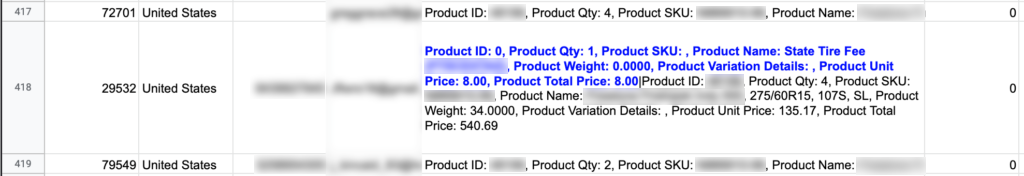

Backoffice Views of Excise Tax Manager

Other Applications of Excise Tax Manager

In addition to Excise Taxes, this app can also be used for many other scenarios that don’t have a solution on BigCommerce. The app is sometimes referred to as a solution for “Destination-Based Product Fees.”

An example of this may be a “Cold Shipping” fee that a merchant charges to ship temperature-sensitive food products across the country. A business that sells and ships fresh fruits and vegetables, for instance, may charge more if they need to ship the produce farther, since they will need to pack the shipment with more ice and insulation for a longer trip. This store can group their products into Product Groups, create Zones originating from their shipping facility based on the number of days of transit to the destination, and charge an additional Flat Fee Rate based on the destination.

The Results: A Reliable Solution to Calculate and Report Tire Excise Tax and Destination-Based Fees

The online tire retailer now has a seamless integration with their BigCommerce storefront that accurately charges customers excise tax in addition to standard sales tax based on where products are shipped. This solution saves the company countless hours of recordkeeping and the stress of worrying about hefty fees and penalties for non-compliance with tax laws.

After working with IntuitSolutions, they are now equipped with custom functionality to calculate tire fees with ease, while customers benefit from improved pricing transparency and better user experience.

Could your BigCommerce store design use a refresh, or custom integration? Are you considering migrating to BigCommerce from another platform, or starting your own ecommerce business? We’re an Elite BigCommerce Partner Web Design Company and work exclusively on the BigCommerce platform. Send us a message or give us a call, 866-901-4650, to discuss how we can help your business succeed online.